- What Is a Credit Freeze?

- Should You Freeze Your Child's Credit?

- Credit Lock vs. Credit Freeze

- Fraud Alert vs. Credit Freeze

- Freeze Your Credit at Each Credit Bureau

- Freeze Your Credit at Equifax

- Freeze Your Credit at Experian

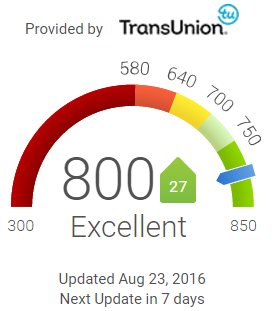

- Freeze Your Credit at TransUnion

- Unfreezing Your Credit

- Reasons to Unfreeze Your Credit Report

The three free credit reports consumers may request per year provide important information and a means to help consumers protect against identity fraud. The information contained is invaluable.As a consumer, you may request a free copy of your credit report from each of the three national credit bureaus every twelve months.

Having your identity stolen is no stroll along the beach. Getting your name cleared takes a lot of time and effort and sometimes money. Victims of identity theft often suffer months and even years after it occurs. It can seem like you’re the one doing time even though you weren’t the one who committed the crime. To prevent your identity from being stolen, or to prevent further identity theft after your identity has already been stolen, you might consider freezing your credit report.

How a Security Freeze Works

Your credit report contains information about your payment patterns that creditors and lenders use to make credit decisions about you. When you freeze your credit report, creditors and lenders can’t pull your credit report or credit score (the numeric value given to your credit report) unless you’ve provided the credit bureau a password to unlock your credit report. Since most banks require a credit check, an application for credit would likely be denied. You can freeze your credit report at all three major credit bureaus, but it must be done individually.

The security freeze isn't completely foolproof. Creditors and lenders with whom you already have accounts can access your credit report and score without you first unlocking your credit report. Certain law enforcement agencies and other government entities can access your credit report and score despite a security freeze.

The freeze doesn’t affect your credit score though it may make it harder for you to check your credit score through third-party websites.

Should You Freeze Your Credit Report?

Consider placing a security freeze on your credit report if any of the following applies to you.

- You’ve been a victim of identity theft.

- Your credit card number has been stolen

- Your mail has been tampered with or stolen

- You want to protect yourself from identity theft

- You’re subscribed to a credit monitoring service

State Law and Security Freezes

Most have laws requiring credit reporting agencies, aka credit bureaus, to allow security freezes on credit reports. However, 9 states (Alabama, Alaska, Georgia, Iowa, Michigan, Missouri, Ohio, and Virginia) don’t have such laws. For these states, all three credit bureaus, voluntarily allow consumers to freeze their credit reports.

In most states, the freeze remains in effect until you remove it. In a few states, the freeze expires after seven years. Check the credit bureau websites for the security freeze laws in your state.

Fees range from $5 to $20 to freeze, temporarily lift the freeze, remove the freeze, or to replace your PIN (the personal identification number used to freeze or unfreeze your credit report). If you’ve been a victim of identity theft, there is no fee to freeze your credit report. Some states also waive the fees for seniors over a certain age.

How to Freeze Your Credit Report

You must freeze your credit report at each credit bureau individually since there’s no way to freeze all three credit reports at once. Requests to freeze your credit report must be made in writing and should include your name, address, date of birth, social security number, a copy of a valid id, proof of address (e.g., a copy of a utility bill) and payment. Payment can be made via check or credit card.

Special Documents for Identity Theft Victims

Get Your 3 Credit Reports

In most states, you don't have to pay to freeze (or unfreeze) your credit report if you've been a victim of identity theft. Identity theft victims should provide proof of the theft, i.e., a copy of a police report, identity theft report, or DMV report.

Pull All Three Credit Reports Free

Send copies because the credit bureau probably won't return your documents. Don't send originals.

Finally, mail your request via certified mail with return receipt requested to the credit bureau.

After the credit bureau receives your request, it will respond with confirmation that your credit report has been frozen. You will also receive a PIN or password to use whenever you need to temporarily unfreeze or permanently remove the freeze from your credit report.

Freezing Your Credit Report at Each Credit Bureau

Visit each credit bureau’s site to get more information about placing a security freeze on your credit report.

- Equifax: Freeze Your Equifax Credit Report, 1-800-685-1111 (NY residents 1-800-349-9960)

- Experian: Freeze Your Experian Credit Report, 1-888-397-3742

- TransUnion: Freeze Your TransUnion Credit Report, 1-888-909-8872

Note that credit bureaus may experience high call volumes and web traffic after major data breaches and other widespread identity attacks. You may experience long phone wait times and even have difficulty accessing the credit bureau online security freeze forms during these times.

You can also place a security freeze by mail (use certified mail). Make sure you send the following information in your request:

- Your full name, including your middle initial any generational suffix (e.g., Jr., II, etc.)

- Complete current address, and previous addresses for the past two years

- Date of birth, month, day, and year

- Social security number

- Proof of identification (e.g., a photocopy of your valid driver's license, passport, state ID, military ID, or birth certificate)

- Address verification (e.g., utility bill, cell phone bill, pay stub. Do not send a credit cards statement, magazine subscription, voided check, or lease agreement)

- Payment (check, money order, or major credit card)

Get All Three Credit Scores Free

Here are the credit bureau addresses you should use to mail your security freeze application and documentation.

Equifax Security Freeze

P.O. Box 105788

Atlanta, Georgia 30348

Experian Security Freeze

P.O. Box 9554

Allen, TX 75013

All 3 Credit Scores Free No Creditcard Required

TransUnion LLC

P.O. Box 2000

Chester, PA 19022-2000